Do you actually live the Wolf of Wall Street lifestyle? Can you give some background about who you are?

When it comes to my lifestyle, I probably live the opposite of the “Wolf” lifestyle. I’ve always aimed to spend as little as possible while I’m young so that I can achieve complete financial independence — the freedom to spend whatever I want, whenever I want, without ever worrying about money. That’s been my life goal from the start.

Just for the record, my total P&L is at $256,716 at the time of writing this. I’ve had to switch accounts after a few months for security reasons but only my main account can appear on the right hand page stats for now.

The idea of being trapped in a corporate 9-to-5 always terrified me. I saw so many of my peers heading straight down that path, and I knew it wasn’t for me. I kept asking myself: Why can’t I make a machine work for me, instead of having to work myself?

Eventually, I realized that such a machine does exist — in many forms. The simplest one is the stock market. A stock is just a small piece of a company that works for you; you don’t have to do anything. That realization gave me immense excitement and confidence.

From there, I immersed myself in learning everything I could about investing, with a special focus on the greatest investor of all time, Warren Buffett. After years of studying and refining my approach, I’m proud to say I’ll probably never have to work a corporate job.

I could go on about this topic all day, but since we’re here to talk about Polymarket, I’ll save the rest for another time.

As for my name, TheWolfOfPoly, the story goes back to when I first joined the site. Not long after, I came across its most profitable user at the time — Domer. He had a Ryan Gosling profile picture that I thought was great, so I decided to take inspiration from it and pick another famous actor for myself. Leonardo DiCaprio immediately came to mind, since The Wolf of Wall Street perfectly captured the spirit and motivations I saw in many of the site’s users — or at least, that’s what I thought back then. And that’s how TheWolfOfPoly was born.

I know you trade Mention Markets a lot. What is your strategy / philosophy trading these markets?

I’ve never been someone who likes taking big risks — or significant risks at all, really. I’m naturally risk-averse because my top priority is always protecting my capital. So I had to find strategies that could generate solid returns without exposing me to major drawdowns. That’s when I discovered sniping mention markets. Sniping, meaning being the first to act when a word is said or when new information breaks, turned out to be the perfect fit for me.

What is your biggest win in a mention market?

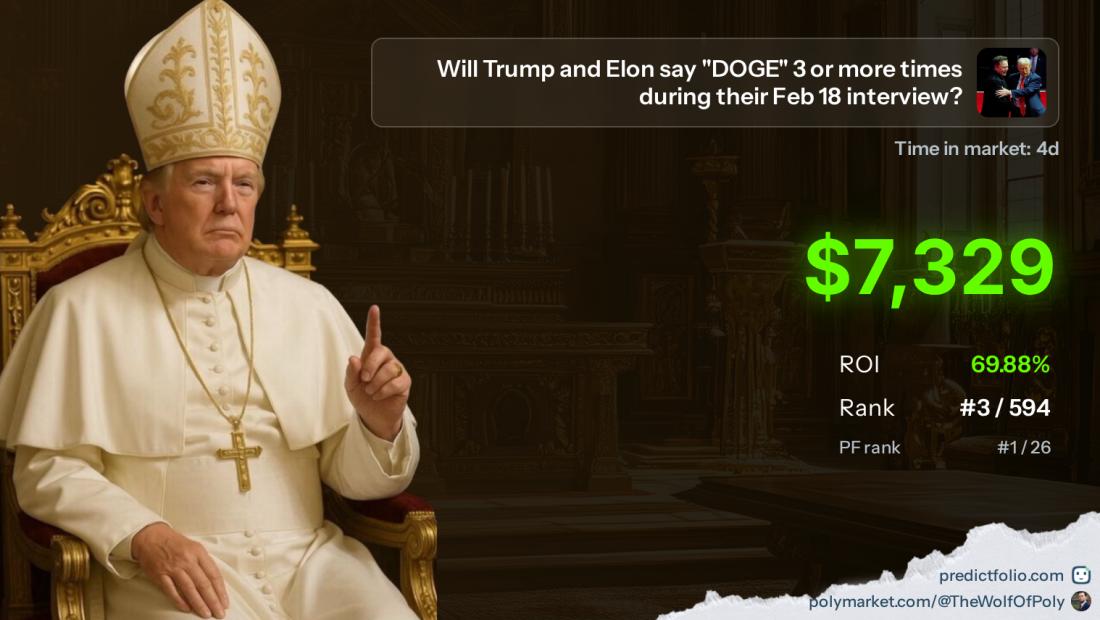

I made over $7,000 by realising that Trump & Elon said the word "DOGE" 3+ times during one of their interviews. I managed to find a transcript of the full interview before anyone else could and got a big win out of it.

What is your biggest loss in a mention market?

This one still stings. I misheard Trump saying “Debate” for another word, and it cost me $27,000 — roughly three months of profits gone in an instant. It taught me a valuable lesson: never go all-in, even when you’re absolutely certain. I wish I had learned that one from someone else instead of the hard way. Thankfully, I stayed focused, kept my head up, and eventually recovered the entire loss — and much more. Today, it’s nothing more than a small blip in my record.

You made quite a lot of money so far, is this your full time job now? Or still a hobby / side hussle

I don’t really like calling it a job, because I only do it out of choice. For me, it’s a great way to learn about the world — and, of course, to make money. My main source of income has always been my stock portfolio, but these days I’m probably earning even more on Poly. I feel very fortunate to have discovered the site.

Do you have a background in gambling or trading other things?

I started investing in the stock market when I was 18, but I wouldn’t say that experience helped me much with Polymarket. I also spent five years studying Economics and Finance at university, yet most of the “success” I’ve had — both in stocks and on Polymarket — came from what I learned on my own. Nobody’s going to tell you how to make money; you have to figure it out yourself. That’s been my experience. In university, they’ll teach you plenty of formulas filled with Greek letters that make you sound sophisticated, but in the real world of investing, they don’t actually work.

How much did you start with? Did you make deposits? When did you start betting larger size?

I’d love to say I started with almost nothing, but the truth is I began with about $300. When I realized I could make a risk-free 1% by buying certain words Trump had already said at 99 cents on the dollar, I decided to deposit around $15,000. Looking back, though, I could’ve easily made just as much without that deposit if I had simply stuck to regular sniping and compounded the $300 over time.

I assume your trading is somewhat automated or you at least have your own terminal to trade? Did you code something to gain an edge in mention markets? How much of your trading is automated?

On that topic, I’m afraid I can’t reveal my methods — I’m sure you understand why!

What's your approach to position sizing? Kelly criteria, etc? Do you hold no matter what? Sell early?

I usually just go with what feels most comfortable. I’m not a fan of rigid formulas like the Kelly criterion. Instead, I prefer a more intuitive approach — similar to what legendary investor Charlie Munger once described learning in the Army: “The ROTC taught me to fire mortar shells one shot over, one shot short, and then kapow. Well, I never shot any damn shells, but I’ve been using that mental trick all my life. That’s how I determine what size to make something. Over and under and kapow.”

In Polymarket terms, if you feel uncomfortable with your current position size, it’s probably too big. If you feel like you’re not betting enough, it’s probably too small. The right answer is usually somewhere in between.

Any markets you avoid entirely and why?

I tend to avoid Middle East markets because I don’t know enough about them. It’s not fun competing against people who have a much deeper understanding of a topic than you do. I also try to stay away from foreign politics in general.

Do you have any general tips for people looking to get into prediction market trading?

If you’re just starting out, I’d recommend beginning with a small amount — that way, you don’t risk blowing up quickly. Early on, the main goal should be to learn as much as you can. Focus on one or two markets that genuinely interest you, or where you have good reason to believe you know more than most people. If you do enough research, you’ll probably have an edge over others and you could correct any potential mispricings. Good luck!

Car

Car PredictFolio Team

PredictFolio Team