Do you think you have an edge in Indian-related markets or those involving neighboring countries, like this years India–Pakistan conflict?

I do think I have an edge in India-related markets. Indian markets are particularly attractive to me because Polymarket is dominated by Western traders and many of them have distorted understanding of how India approaches national security and diplomacy.

During the India–Pakistan conflict in May, there were several markets tied to the conflict. One of them asked whether India would launch military action against Pakistan. The terrorist attack happened on April 20th and by May 5th India hadn't responded. Traders assumed this meant retaliation was unlikely, essentially because if it hasn’t happened by now, it won't happen at all. I think a lot of them were projecting the dynamics of Middle Eastern conflicts onto South Asia, where responses are much faster and more predictable. But being from India, I had a different read.

The Indian government often takes its time, but politically, the current administration can't afford to look weak on national security. From my perspective, retaliation was not just likely, it was almost inevitable. I took a position based on that conviction and made around $5,000 on that market alone. Once the conflict escalated and then de-escalated over just a few days, there were about five India–Pakistan markets and I ended up winning all of them and made roughly $8,000 total. Betting on a conflict so close to home was both thrilling and scary.

There were real missile alerts in my city, fortunately everything was intercepted. But experiencing that while simultaneously trading those markets made the whole situation feel surreal.

When did you start betting or predicting? What got you into it?

I was a software engineer at some big tech in India. Left job to try some venture. I was researching different startups and got this really interesting idea of betting on events. I googled on this and discovered Polymarket. I was amazed that someone has already built something I had in my mind. This was my first time betting, so I started cautiously. I deposited $10 initially to test things out. Once confident the website is legitimate, I deposited further.

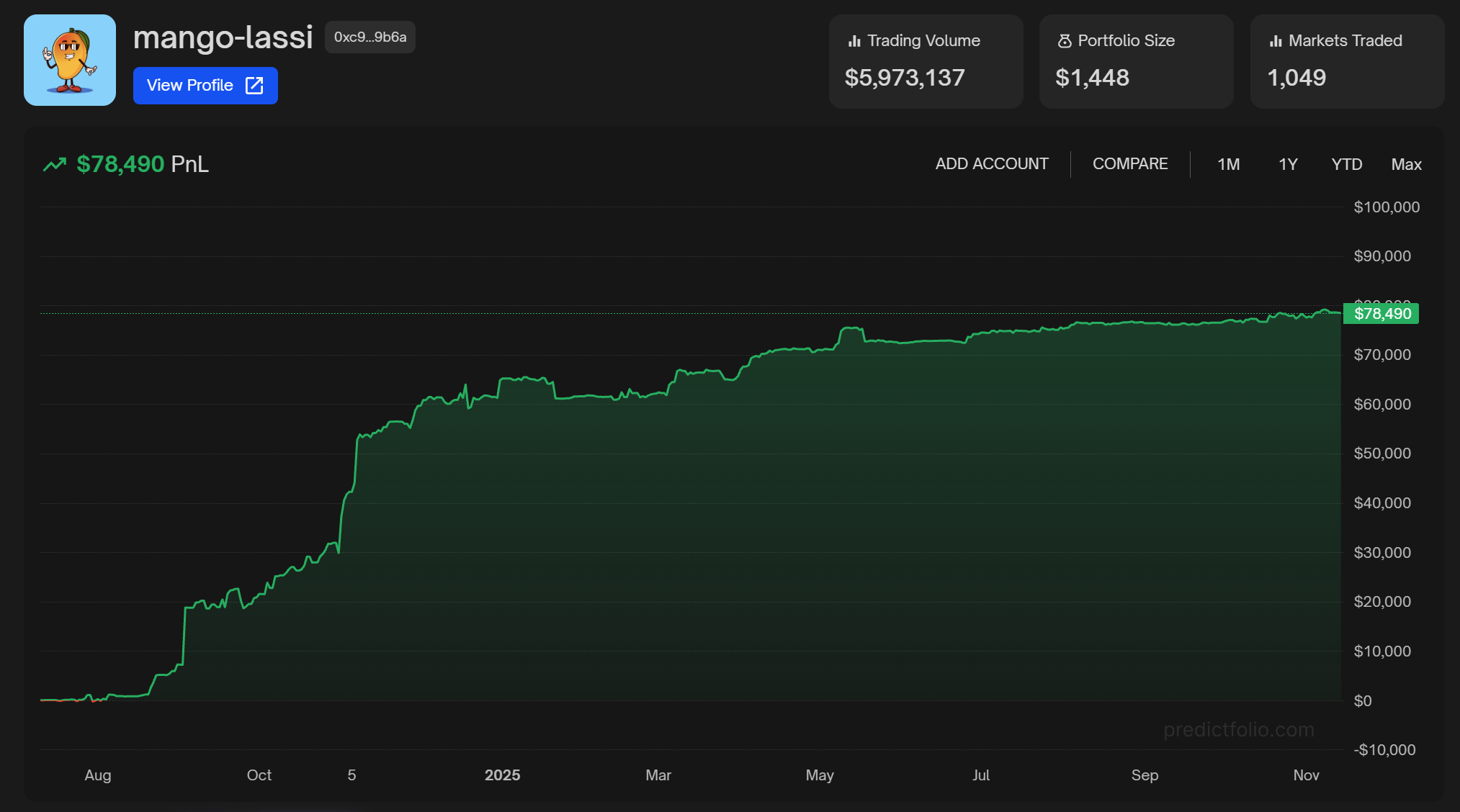

You’ve made over $130,000 so far, but in the last few months your gains have slowed down. Why do you think that is?

Firstly, I took some major hits, one being the Romanian presidential election market which I've discussed later. Secondly, life got busy. I recently bought a new home partially funded by my Polymarket profits. The entire process took few weeks during which I wasn't active.

What’s your approach to position sizing?

I don't like Kelly as it's too aggressive for my risk tolerance. I usually cap my bets to 10% of my portfolio keeping my downside in check. Earlier when my portfolio was small, I was comfortable with 20% cap since losing that amount of money wouldn't have affected me much. As for holding periods, I generally prefer to hold till resolution as I'm not the fastest at reacting to new information in real time. Actively trading isn't really my strength.

Walk me through your biggest winning trade. What did you see that others missed?

My biggest win came from the Trump-Lex Fridman mention market. Trump was scheduled to appear on Lex's podcast, with the episode set to go live on YouTube at 10:30 local time. I and RememberAmalek found the transcript publicly posted one hour before the video. We both loaded up on cheap shares before the rest of the market caught on. When the video eventually went live and confirmed the mentions, each of us walked away with around $12,000 in profit.

What’s your biggest losing trade? and what went wrong?

My biggest loss came from the Romanian presidential election market where I lost roughly $10,000. I had a sizable position on Simion, who looked like a strong value play at around 70c. But in the end Dan won, an outcome I still see as something of an upset. What went wrong

Massive turnout - this shift should have changed my assessment of the odds

TV debate turned out to be a pivotal moment. Simion created unnecessary drama, while Dan stayed calm. That performance resonated with voters more than I expected.

It was an expensive lesson, but a useful one for how I evaluate future election markets.

How would you describe your overall betting strategy?

My overall betting strategy is fairly simple: I try to enter markets where I believe I have a genuine edge. Mention markets are a good example. I generally avoid bonding and stay away from high-priced shares (anything above 95¢) because the upside is tiny compared to the downside risk. On the risk-management side, I cap any single position at around 10% of my portfolio. It forces me to stay disciplined, even when a market looks extremely tempting.

Which types of markets do you trade the most and which do you generaly avoid?

Most of my profits come from mention markets. I have earned roughly $70,000 from them alone. I especially like Trump mention markets because his speech patterns are so unpredictable. He can spam his favorite words like "border" at any moment and sometimes hold them back unexpectedly. This unpredictability creates great opportunity if you're paying close attention. I tend to avoid sports and crypto markets as I feel I don't have any real edge there. Without an analytical advantage, I'd just be gambling.

Car

Car PredictFolio Team

PredictFolio Team