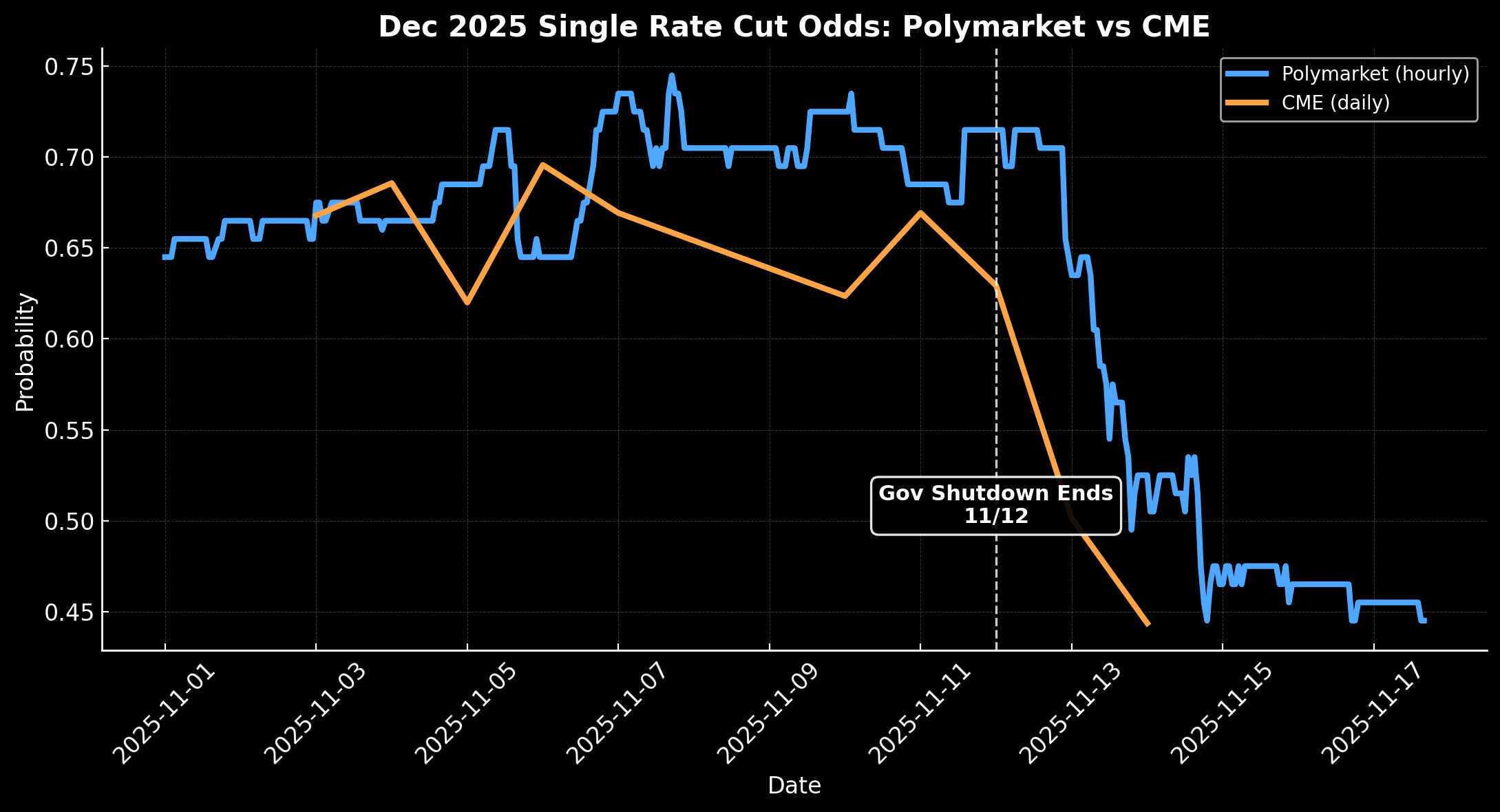

This analysis compares CME’s implied probability of a 25 bps rate decrease with Polymarket’s 25 bps decrease contract across the first half of November. Both datasets show the same defining feature: Nov 12, the day the government shutdown ended, is the clear pivot point where single-cut expectations shift lower.

1. Stable Range Through Nov 1–10

Both markets held in a narrow band for a 25 bps decrease, with no meaningful momentum:

- Polymarket: 0.65–0.70

- CME: 0.62–0.68

There was no major divergence during this period.

2. Inflection Begins Around Nov 11–12

The first sustained move occurs at the same time in both markets:

- CME: Begins its decline on Nov 11 and continues into Nov 12

- Polymarket: Shows its first clear break immediately after Nov 12

The timing aligns with the government shutdown resolution.

3. Post-Shutdown Repricing

After the shutdown ended on 11/12, both markets moved into a multi-day decline:

- Polymarket: Falls from about 0.70 into the 0.45–0.52 range

- CME: Falls from about 0.63–0.67 into the 0.44–0.50 range

By mid-month, both probabilities are below 50 percent, which means a single December rate cut is no longer the base-case scenario in either market.

4. Comparative Behavior (Timing and Magnitude)

- Timing: CME begins softening earlier, while Polymarket accelerates immediately after the shutdown

- Magnitude: Both series decline roughly 15 to 20 percentage points

- End State: Both converge near the 0.45–0.50 area

Even with different frequencies, daily for CME and hourly for Polymarket, the overall trajectory is nearly identical.

Additional Context

The move away from a December cut tracks with a period of significant macro uncertainty.

- The government shutdown created a temporary data freeze, which delayed CPI, payrolls, and other releases

- Fed officials emphasized data dependency, but had little current data to guide decisions

- Public remarks during this period shifted more cautious and lifted the bar for a December cut

The absence of fresh data, combined with more conservative Fed communication and operational uncertainty during the shutdown, contributed to a simultaneous repricing across both markets.

What had been about 67 to 70 percent odds earlier in the month shifted into sub-50 percent territory, one of the sharpest transitions so far in the December rate-cut path.

Conclusion

The timeline shows:

- Stable pricing from Nov 1–10

- Inflection beginning around Nov 11–12

- Parallel downward repricing after the shutdown ended

- Convergence below 50 percent by mid-month

Across CME and Polymarket, Nov 12 is the key pivot that marks the shift in expectations for a December 25 bps cut.

Aaron

Aaron