If you think Polymarket is only about making predictions and getting paid when you’re right, you’ll be surprised by how many different ways traders actually earn on the platform. Experienced users already take advantage of these techniques, but new traders often have no idea how much additional opportunity Polymarket offers beyond simply guessing the correct outcome. This article is meant to help people who are still exploring Polymarket discover extra ways to profit.

Providing Liquidity

Just like on traditional exchanges, prices on Polymarket are determined by bids and asks that traders place on the order book. If there is a gap between the highest bid and the lowest ask, the market becomes less efficient. To encourage tighter spreads and deeper liquidity, Polymarket pays out daily USDC rewards to traders who place helpful resting limit orders.

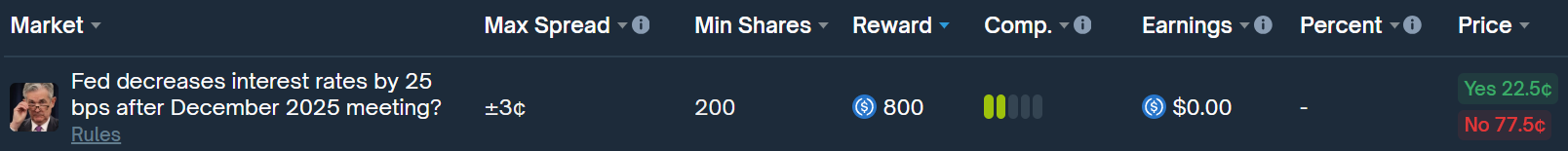

You can check all eligible markets by visiting the Polymarket Rewards page. There, you can filter markets by:

- Max Spread – This shows how far from the midpoint of the market you are allowed to place an order and still qualify for rewards. The closer your order is to the current bid/ask spread, the higher your score.

- Min Shares – The minimum number of shares your order must contain to be eligible. Bigger orders earn a larger share of the rewards.

- Reward Size – The total pool of USDC that will be distributed to liquidity providers in that market for the day. The pool is split proportionally based on how competitive your orders are compared to others.

Once you find a market that fits your criteria, you can place a resting limit order inside the allowed spread. If you don’t want to take on actual exposure, you can simply place your order far enough away that it’s unlikely to be filled, but still inside the reward band. Rewards above $1 are paid out daily around midnight UTC.

4% Holding Rewards

Polymarket offers a 4% annual yield on selected long-term markets. These are usually markets that won’t resolve for years, such as elections far in the future. The yield is paid to users who simply hold positions in an eligible market.

Some traders even hold symmetrical positions (for example, equal amounts of Yes and No), which essentially neutralizes directional risk while still earning the 4% yield.

You don’t need to hedge both sides, though. If you already believe an outcome will happen, the 4% simply becomes an extra bonus on top of your bet.

The complete rules and list of eligible markets can be found on Polymarket documentation page.

Arbitrage Opportunities

Arbitrage is a strategy where you profit from price differences for the same event across different markets or different parts of the same market. The goal is not to predict the future but to exploit temporary price inefficiencies.

Polymarket arbitrage comes in two forms:Internal and External.

1. Arbitrage Inside Polymarket

Sometimes, the total cost of buying all outcomes of a multi-outcome market adds up to less than 100 cents. When that happens, you can buy one share of every outcome, guarantee receiving one dollar at resolution, and lock in a risk-free profit.

Here is a soccer match market example:

- Team A to win: $0.5546

- Team B to win: $0.2502

- Draw: $0.1897

Buying all three costs:

0.5546 + 0.2502 + 0.1897 = $0.9945

If you buy 1 share of each outcome, investing $0.9945, you are guaranteed to receive $1 at resolution, meaning you make a 0.55% profit instantly. That sounds tiny, but if you do dozens or hundreds of these trades, the returns add up.

These opportunities are rare and often disappear within seconds and most of the times can only be caught by price-tracking tools or trading bots.

2. Inter-Market Arbitrage

There are many more arbitrage opportunities when you compare Polymarket prices with other platforms like prediction markets, traditional bookmakers, or even crypto exchanges.

Let’s say you want to take advantage of an arbitrage opportunity in a tennis match.

Polymarket odds:

Player A: 40% (x2.5 if they win)

Player B: 60% (x1.67 if they win)

Bookmaker odds:

Player A: 2.80 (around 35.71%)

Player B: 1.45 (around 68.97%)

Bookmaker odds always add to more than 100 percent because of the built-in margin. In this case: 35.7 + 69.0 = 104.7%

Suppose you do the following:

- Bet $100 on Player A at the bookmaker at 2.80.

- Buy 280 Player B shares on Polymarket at $0.60 each (total cost $168).

Now let’s check both scenarios.

- Player A wins:

$180 profit from bookmaker

$168 loss on Polymarket

Net: +$12 - Player B wins:

$100 loss at bookmaker

$112 profit on Polymarket

Net: +$12

This structure allows us to make $12 risk free on a $268 investment. Real cases may not be this clean, but even smaller discrepancies can be profitable. Many websites track odds across different bookmakers, which makes identifying arbitrage gaps easier.

Post-Event Betting

Another low-risk earning method involves betting on events that have already been decided in real life but have not yet been resolved by the Polymarket oracle.

When an event concludes, the winning outcome does not instantly jump to 100%. Traders often sell early at 99.5 cents or lower instead of waiting hours or days for official resolution. If you buy at 99.5 cents and the market resolves at $1.00, you pocket half a cent per share with almost no risk.

This works best for events with extremely clear outcomes. For example, "Will Bitcoin hit $100k today" is straightforward. Something like "Will Trump praise Xi” carries more risk because wording and interpretation matter.

Final Thoughts

None of these strategies will make you rich overnight, but together they can significantly boost your returns. They also carry very little risk when used properly. A few pennies earned across hundreds or thousands of trades can add up to some solid profit over time.

If you’re just getting started, try exploring a few of these methods on a small scale. Over time, you’ll develop strategies that work for your risk level and trading approach. Good luck, and see you on Polymarket!

0xAnikUKU

0xAnikUKU